irs tax levy on bank account

A tax levy on your bank account will only occur if you have ignored these notices and other attempts to collect on your debt. The IRS can garnish wages take money from your bank account seize your property.

Irs Bank Levy Release Protection Genesis Tax Consultants

Removal of IRS Levy.

. If the levy on your bank account or other account is creating an immediate. If the levy on your wages is creating an immediate economic hardship the levy must be released. An IRS bank levy is a seizure of the money in your bank account.

If this was a mistake you can also file for lost funds. An IRS bank levy is a physical claim on an asset or fixed value of an account. The IRS will find your bank accounts based on the information you provided on your tax return or by using your Social Security Number.

In some cases the IRS has your banking details from previous tax returns and in other cases it uses your social. The collected amount helps settle outstanding tax owed. What Is an IRS Bank Levy.

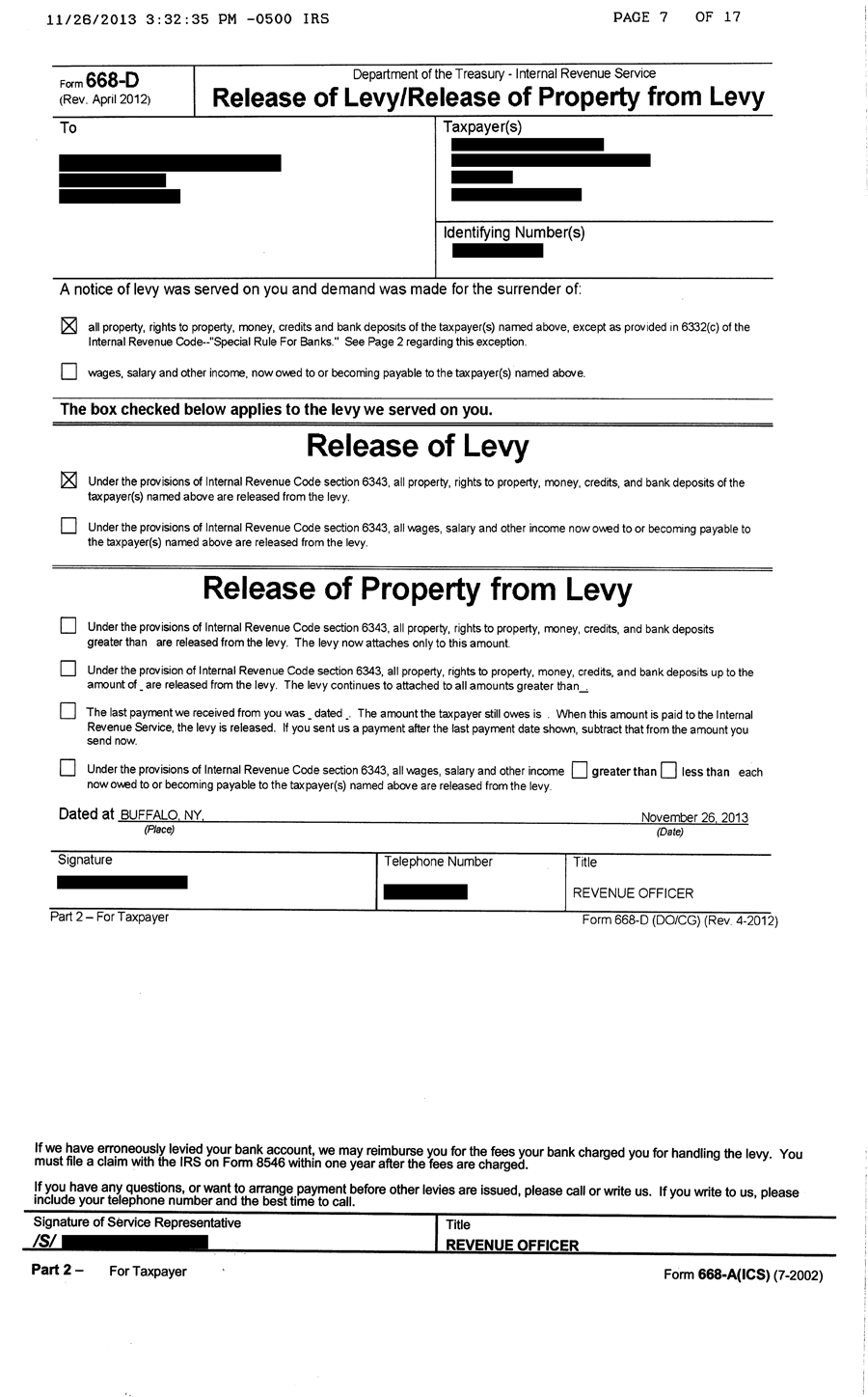

After the levy proceeds have been sent to the IRS you may file a claim to. The IRS must issue another levy if there are more funds in your account. If the IRS denies your request to release the levy you may.

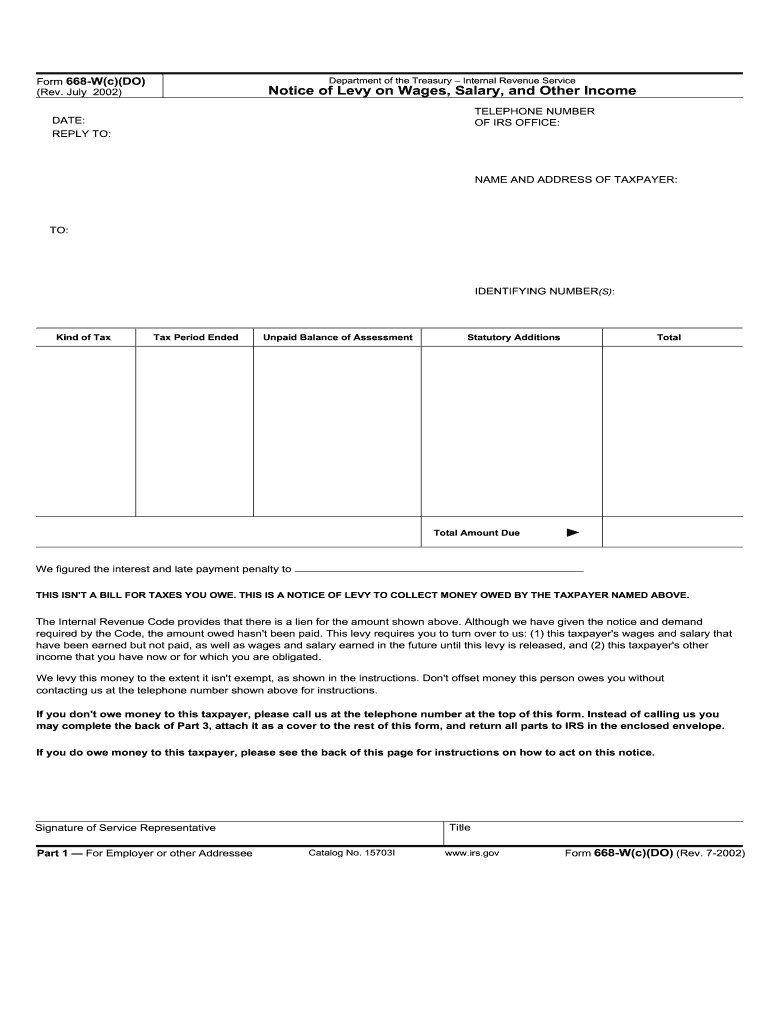

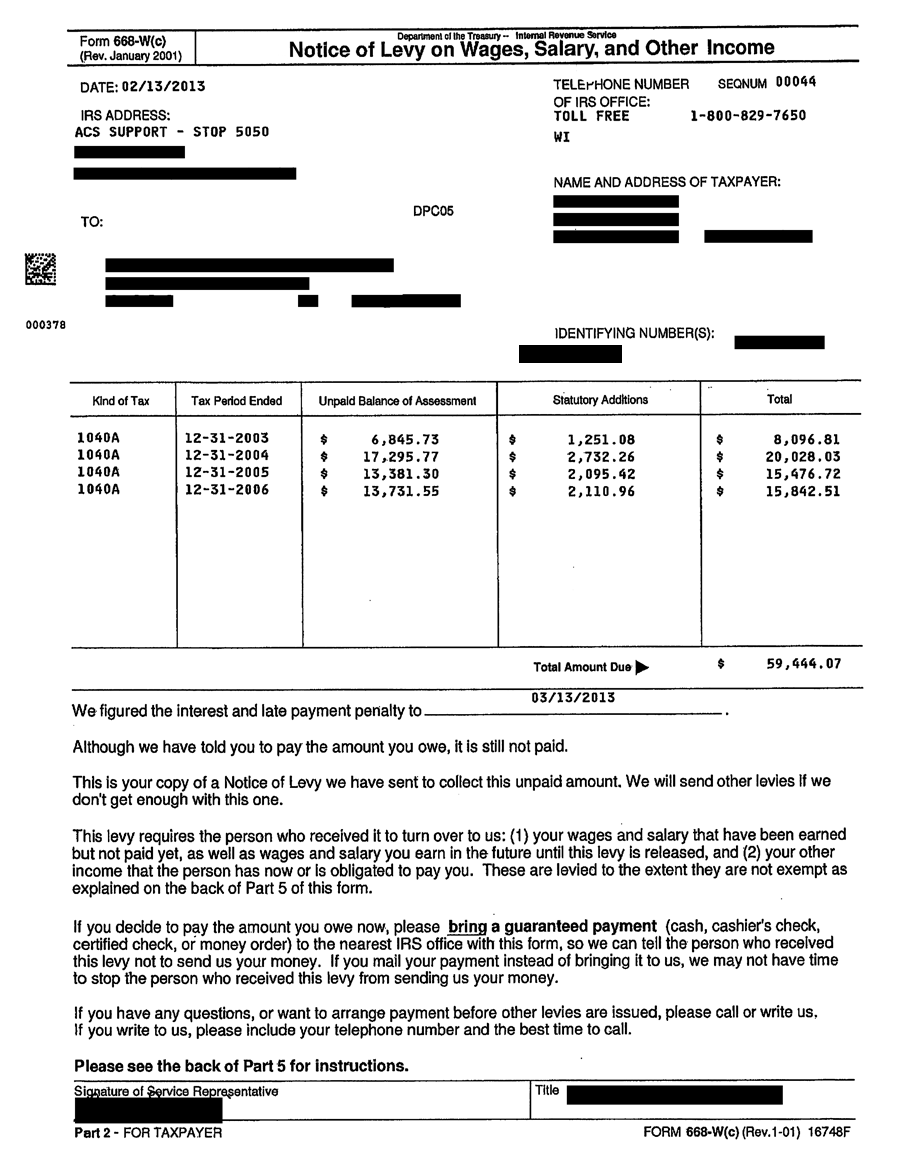

Under IRC 6332 c a bank must wait 21 calendar days after a levy is served before surrendering the funds in the account including interest thereon held by the bank subject to. When an IRS bank levy occurs banks are required to hold onto your levied funds for 21 days before. A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes.

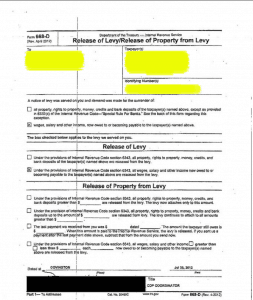

The agency will send Form 668-A9 CDO to your bank. It can garnish wages take money in your bank or other financial account seize and sell your. It is important to understand that the bank must hold your funds for 21 days before releasing them to the IRS once your bank account is levied.

How Long Will the IRS Levy Your Bank Account. The IRS can seize all of the funds in the account up to the amount you owe in back taxes penalties. IRS Levies on Bank Accounts.

The first thing you need to understand is the mechanics of an IRS bank levy. A bank levy allows the IRS to legally seize any money a taxpayer has in any type of bank account. You may appeal before or after the IRS places a levy on your wages bank account or other property.

Your initial reaction should be to identify the source of the levy and to make sure that your account is indeed overdue. A levy on your bank account takes only what is in the account at the time your bank receives the levy. Levy An IRS levy permits the legal seizure of your property to satisfy a tax debt.

When the IRS issues a bank levy they are claiming the contents of your bank account to satisfy your. An IRS Tax Levy is when the IRS says you owe more than you have paid and then after subsequent attempts to collect the total they take it directly from your bank account. The IRS generally cannot take action until 30 days.

If the IRS decides to use a bank levy it tracks down your bank account. The IRS serves a bank. If the IRS places a tax levy on your bank you have 21 days.

The IRS can place a levy on your bank account to collect on your debt allowing it to take your funds. More In File The IRS can also release a levy if it determines that the levy is causing an immediate economic hardship. When an IRS Levy has been issued to your bank they are required to hold the entire funds in your account for 21 daysThe bank levy can be issued to your checking and savings accounts.

If you do not either pay the tax in full by the due date stated in the LT11 or call the IRS number on the LT11 before that date to resolve your tax problem the IRS could send an IRS bank levy to.

Can The Irs Take Money From Your Bank Account Bell Davis Pitt

Irs Bank Levy Precision Tax Relief

Irs Audit Letter Cp504 Sample 1

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

Tax Letters Washington Tax Services

How Often Can The Irs Levy My Bank Account Rush Tax

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

Tax Audit Help Stopping An Active Irs Levy Or Garnishment

Tax Letters Washington Tax Services

3 17 277 Electronic Payments Internal Revenue Service

Irs Bank Levy Notice Of Levy What Should I Do

Irs Tax Levy How To Avoid And Release

What Is An Irs Bank Levy And How To Respond The W Tax Group

State Tax Levy How To Stop A Tax Levy Legal Tax Defense

Can The Irs Levy Or Garnish My Bank Accounts Tax Attorney Newport Beach Ca Orange County Dwl Tax Law Daniel Layton

How To Use Chapter 13 Bankruptcy To Alleviate Irs Tax Levies